Do you wonder which platform is best for you to order your food online? Have a look below to better understand the services provided by Swiggy vs Zomato.

With the pandemic far from over, the food delivery system has been overwhelmed by the jobs responsible for serving customers. The two largest food delivery platforms are Swiggy and Zomato. Now, their growth over the past decade has been in high normalized margins and low normalized margins. We see a high-end competitive structure between these two startups in terms of marketing strategy, online growth, and revenue generation.

Food delivery sector market size breakdown

Zomato and its rival Swiggy, who together own 90–95% of the market share, are the market leaders in India’s food delivery industry. These businesses initially just offered meal delivery services, but they have subsequently expanded into the grocery delivery market.

Furthermore, India’s online food delivery market size from 2016 to 2025

The Indian internet food delivery sector was valued at close to $3 billion in 2020. By 2025, it is estimated that the delivery market would acquire 35% more traction and reach around 13 billion dollars.

Post-COVID-19 expansion of the food delivery market

Lockdowns and restricted movement during the coronavirus epidemic were major contributors to the country’s explosive online food delivery market growth in the online food delivery market. Restaurants and cafés that previously did not provide delivery services were forced to do so in order to remain in business. However, food delivery services developed client retention techniques including pay-later and subscription offers to maintain this greater flood in cash following lockdowns.

Demand for food delivery services

A lack of workers in the delivery industry was caused by the increased demand for online food delivery services, increases in petrol expenses, and flat compensation. Additionally, around 40% of the drivers employed by top delivery firms like Zomato and Swiggy leave their jobs within a month of starting. Increasing pay and switching to electric vehicles may make it easier to keep freelance workers.

H.S. Sethu and Bhavya Saini (2016) did an excellent job of studying how students perceive, act, and feel about online food ordering and delivery services. The study highlighted how time management and access to favourite foods at any time of day are made possible for students by online meal ordering and delivery services. Researchers have also shown that students using these services are supported by simple access to the internet.

A quick glance: Swiggy vs Zomato

| Basis of distinction | Swiggy | Zomato |

|---|---|---|

| Precision of location tracking | More accurate than Zomato | Every time, a person must turn on the locations, it constantly questions if it is turned on. |

| Payment ease | Do not get more payment options to explore and at many places, COD is not applicable | Payment in Zomato is easier and simpler; has Zomato pay |

| Delivery time | Swiggy is faster than Zomato, before time delivery | Considerably slower than Swiggy |

| Offers & Discounts | – | Zomato offers more discounts and coupons as compared to Swiggy |

| Quality of packaging | – | Zomato has better-quality of packaging than Swiggy |

| Customer Support | – | Zomato representatives uphold the highest levels of professionalism. |

Foundation in Zomato vs Swiggy

Swiggy

In August 2014, Nandan Reddy, Sriharsha Majety, and Rahul Jaimini established Swiggy. Rahul Jaimini, age 31, is an IIT Kharagpur alumnus, while Nandan Reddy, age 29, and Sriharsha Majety, age 31, are both graduates of the Birla Institute of Technology and Science (BITS) Pilani.

Beginning in Bengaluru, Swiggy had 25 eateries on its network and six delivery personnel. It has expanded in only three years, employing more than 6,000 delivery executives in more than eight Indian cities, including Delhi-NCR, Mumbai, Bengaluru, Hyderabad, Chennai, Kolkata, and Pune.

Zomato

In 2008, Deepinder Goyal and Pankaj Chaddah, who were both employed by Bain & Company, established Zomato under the name FoodieBay. Initially, the website served as a directory and review site for restaurants. To avoid a potential naming problem with eBay and since they weren’t sure whether they would “simply stick to food,” they renamed the firm Zomato in 2010.

Revenue model in Swiggy vs Zomato

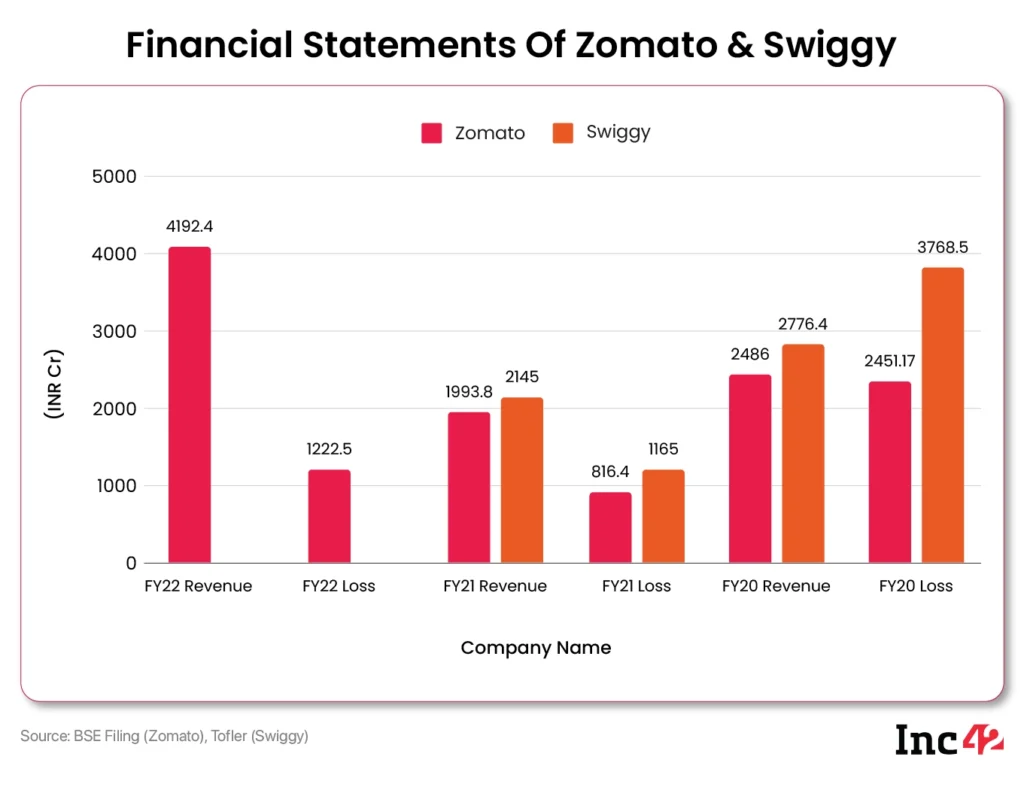

Swiggy and Zomato reported revenues of 25 billion and 20 billion for the fiscal year 2021, respectively. Swiggy still outperformed Zomato in the Zomato vs Swiggy battle though, with about 1.5 million orders per day as opposed to 1.2 million, despite the income decline.

Swiggy

Swiggy relies on two main sources of income to outperform in the Zomato vs Swiggy battle.

- Swiggy derives the majority of its income from the commission it charges restaurants for generating leads and acting as a delivery partner.

- Swiggy also charges a small delivery cost to clients whose purchases fall below a certain threshold, which in most locations is 200 INR.

Zomato

Zomato’s revenue is mostly driven by its three main segments: food delivery, dining out, and hyperpure (formerly sustainability).

- Zomato’s primary source of income is advertising. To increase visibility and reach a wide audience via Zomato, restaurants may advertise their banner on the platform.

- On the basis of orders, Zomato charges a fee to the eateries. Restaurants who make deliveries pay a fee to the business, which is subsequently split between the delivery partners and the business.

- Payment for subscriptions is Zomato’s another significant source of income. Restaurants pay a monthly charge, and in exchange, Zomato provides them with analytical tools.

- Zomato debuted Zomaland and started participating in live events in 2019. Users of Zomato paid admission to get to Zooland, where they also saw live musical performances in addition to eating.

UI & UX in Swiggy vs Zomato

Swiggy provides simple features like food item delivery and quick access, but Zomato has significant capabilities like booking seats and checking locations and restaurants near me.

Both applications’ user interfaces are designed with a tech-savvy consumer in mind and provide a meaningful user experience winning people’s hearts in the Zomato vs Swiggy battle. In contrast to Swiggy, whose platform has been expanded to include grocery and pharmaceutical delivery, Zomato’s app concentrates solely on food.

Funding in Swiggy vs Zomato

Swiggy

One of the greatest investors on the market supports Swiggy. Various investors, including Bessemer Venture Partners, Norwest Venture, Accel Partners, SAIF Partners, Harmony Venture Partners, RB Investments, and Apoletto, have contributed a total of 75.5 million dollars to Swiggy’s fundraising.

Along with funding from Norwest Venture Partners, Swiggy secured a $2 million investment in 2015 from Accel and SAIF Partners. The next year, Bessemer Venture Partners and Harmony Partners, together with other prior and new investors, contributed $15 million to the venture.

In 2017, Naspers led an $80 million financing round in Swiggy. Swiggy has an estimated worth of $3.3 billion by September 2018 and $3.6 billion by April 2020.

2017 saw Swiggy acquire Bangalore-based Asian food company 48East. Later, Mumbai-based food and apparel delivery firm Scootsy Logistics was purchased by Swiggy, which finally shut it down. It bought Mumbai-based milk delivery company SuprDaily in September 2018. The business made a 31 crore investment in Mumbai-based ready-to-eat food manufacturer Fingerlix in 2019.

Swiggy’s valuation increases to $10.7 billion in January 2022 as a result of a $700 million fundraising coordinated by US asset management Invesco surpassing Zomato in the Zomato vs Swiggy competition.

Zomato

Zomato received around US$16.7 million from Info Edge India between 2010 and 2013, providing Info Edge India with a 57.9% stack in Zomato. It received an additional US$37 million in November 2013 from Sequoia Capital and Info Edge India.

Zomato raised a second round of fundraising in November 2014 totalling US$60 million at a US$660 million post-money value. Sequoia Capital joined the fundraising round that was jointly led by Info Edge India and Vy Capital.

While another round of fundraising for US$50 million was led by Info Edge India, Vy Capital, and Sequoia Capital in April 2015. Following that, Temasek, a Singapore government-owned investment firm, and Vy Capital led another US$60 million fundraising round in September.

In October 2018, Zomato obtained $210 million from Ant Financial, an offshoot of Alibaba’s payment network, in exchange for over 10% of the firm. This valuation put Zomato’s market worth at almost $2 billion. Additionally, Zomato had previously, in 2018 received $150 million from Ant Financial.

Zomato secured $62 million from Temasek in September 2020 after Ant Financial’s previously pledged funding fell through.

Zomato received $52 million from the US-based investment group Kora in October 2020 as part of a Series J round of fundraising.

Zomato secured US$250 million in February 2021 from five investors, including Tiger Global Management, at a US$5.4 billion value.

Marketing strategy in Swiggy vs Zomato

Swiggy

Online and offline marketing efforts are both a part of Swiggy’s marketing plan to surpass Zomato in the competition of Swiggy vs Zomato. It uses Facebook, Twitter, Youtube, Pinterest, and Instagram to advertise its campaigns. Among its efforts are Secondtomom, #DiwaliGhayAayi, #SingwithSwiggy, the Know Your Food photo series, and local food walks.

Through these mediums, the business has effectively increased brand recognition and audience engagement. Their Facebook page is often updated, with an average of one post each day.

Swiggy utilises social media not just for advertising but also to interact with consumers, resolve complaints and solicit feedback.

Zomato

Zomato provides a user-friendly and featured webpage, with a global mobile app. The company is concentrating on online marketing platforms for prospective clients. The company is constantly reducing the competition by purchasing its rivals, Zomato has acquired Urbanspoon for $52 million in order to expand into the US, Canada, and Australia to become the greatest resource in the food supply industry.

Moreover, it has a simpler approach to ratings and reviews which helps it get people’s reviews easier and faster. Their firm has grown significantly as a result of integrating additional technologies into their marketing plan.

Promotion of sales Discounts and coupons is one of the finest marketing strategies of Zomato that has kept it leading in the Swiggy vs Zomato competition. Its direct marketing includes calling and sending letters.

Zomato even started a 10-minute meal delivery service after realizing there was more room for growth in the market. To increase its income in the Swiggy vs Zomato competition, the publicly traded firm also introduced a food delivery service between cities. Zomato Pay is a service that allows users to pay at partner restaurants, take advantage of specials, and help those establishments market themselves.

IPO(Indian Public Offerings) in Swiggy vs Zomato

Swiggy is a privately held firm, but it is getting ready to go public, with a target valuation of $800 million, to compete equally with its competition.

Zomato launched its initial public offering in July 2021, making it the first meal delivery firm in the nation to do so.

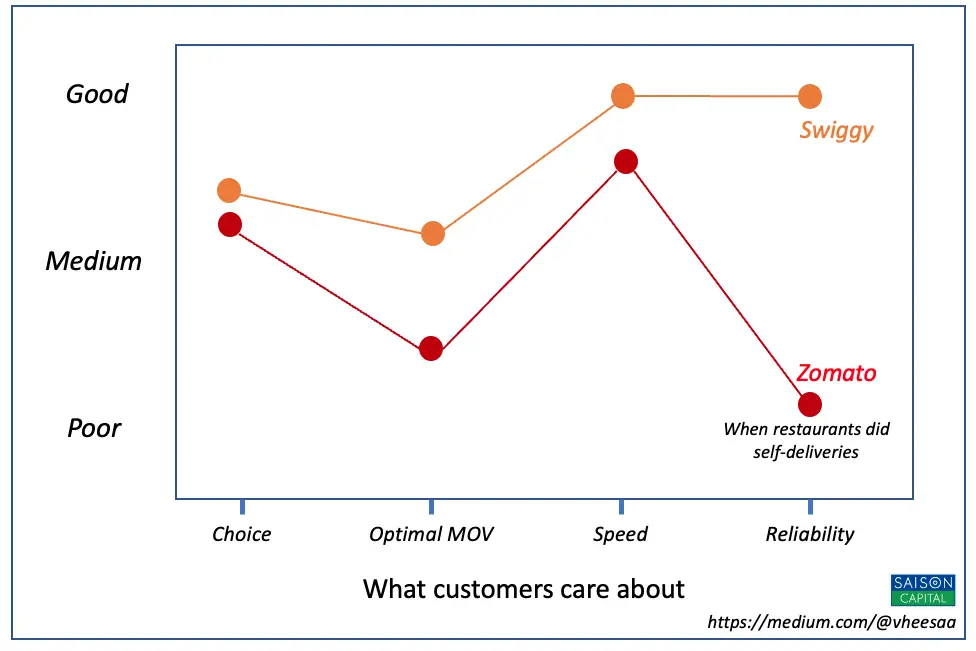

USP(Unique Selling Proposition) in Swiggy vs Zomato

Swiggy’s main USPs are its quick delivery and lack of a minimum order requirement.

Zomato’s USP is its extensive menu selection, which it uses to give the location, reviews, ratings, and other information for practically all restaurants. The directory of information provided for clients to discover neighbouring restaurants and cafes is the primary element that sets Zomato apart in the Swiggy vs Zomato rivalry.

Valuation rivalry, Swiggy vs Zomato

Swiggy, a food-tech platform with headquarters in Bengaluru, has secured $700 million from notable investors, nearly tripling its valuation to $10.7 billion.

The market value of Zomato, on the other hand, has collapsed to close at $9.6 billion falling behind in the Swiggy vs Zomato battle.

Swiggy now holds the decacorn title, while Zomato lost it when its shares earlier fell below the 100 thresholds. Shares of the business fell to an all-time low of 91, and its market value decreased to 71,629 ($9.6 billion).

Therefore, it is evident that Swiggy is now valued higher than Zomato and Zomato has fallen back in the rivalry of Swiggy vs Zomato. Swiggy has achieved decacorn status, a designation given to businesses worth more than $10 billion.

After 2015, Swiggy was able to hold onto a slim lead in the meal delivery market. However, Zomato eventually surpassed its rivals once Uber Eats was purchased.

Zomato dominated the market by 2020, with a market share of around 50%. More than 80% of the market is presently controlled by the two biggest meal delivery companies, which currently have a duopoly.

Zomato operated through 35 companies in FY20, as a result of its acquisitions and business divisions, which have led to its inorganic expansion. It had consolidated revenues of INR 2605 crores. For the same time period, however, its losses increased to INR 2358.6 crores.

Zomato’s revenue during the first three-quarters of FY2020-21 was INR 1,367 crores. Despite not being profitable yet, Zomato did manage to cut their losses by INR 812 crores over the course of three quarters.

Zomato accomplished this by eliminating discounts and raising prices. Selling its share in Loyal Hospitality, situated in Bengaluru, was one of these initiatives. In addition, Zomato closed its branches in Norway, Austria, and Romania.

On the other side, Swiggy reported revenue for FY2019–20 of INR 2776 crores. They lost INR 3768.5 crores throughout the same time period.

Many of Swiggy’s subsidiary businesses also experienced losses. These included the delivery company Scootsy, located in Mumbai, and the milk delivery startup SuprDaily, which reported losses of INR 206.8 crore and INR 272.2 crores respectively during FY20.

Conclusion

Zomato and Swiggy are not giving themselves a chance to compete. Zomato is good at marketing strategies on the one hand, and Swiggy will recommend new places for you on the other. Overall, both have their strengths, and it’s hard to say who is best in Swiggy vs Zomato.