Razorpay Case Study – Success Story of Razorpay

Brief introduction:

Internet in the modern world has introduced us to new ways of banking and other payment services. The world full of advanced technology has extended the availability for everyone towards simplifying the basic processes. The finance industry of banking and payments are one such sector where technological advancements have ushered in major transformations.

The cutting-edge technological advancements have brought in many benefits and introduced the world to concepts of digital and online payments. These concepts have benefited the banking and finance sector largely. We are long past the days when financial transactions were elaborate and tedious processes. Such procedure has been shortened to carrying out such transactions by swiping fingers so as to attempt the setting up of safe and effortless online money transfers. One such platform is our today’s topic of discussion “Razorpay”.

The initials:

Razorpay is an online payment medium in India where businesses can accept/ process/ disburse payments made by their clients. It engages firms to computerize payouts to the workers and sellers. Through Razorpay, businesses can get access to various modern payment gateways like UPI, Mobikwik, FreeCharge, Debit/ Credit cards, net banking, online wallets, etc. The payment gateway of Razorpay can be integrated by mobile as well as computer devices. Razorpay is thus a full-stack financial service provider which offers unique solutions to address the entire length and breadth of the payment and banking journey for any business.

About the company:

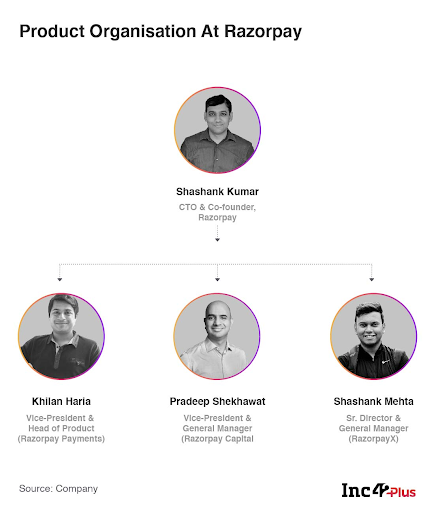

- Founders: Shashank Kumar, Harshil Mathur (CEO)

- Founded in: 2014

- Parent company: Bigo Technology Pvt. Ltd.

- Headquartered: Bengaluru, Karnataka

- Sector: Fintech, financial services

- Website: www.razorpay.com

- Tagline: “Quest for Excellence”

- Key investors: Kunal Shah, Sequoia Capital, Ribbit Capital, YCombinator, Tiger Global, Jeff Huber

- Business model: B2B

Harshil Mathu – CEO, Co-Founder of Razorpay, a BTech graduate from IIT Roorkee. He started his career by serving “Schlumberger” as a Wireline field engineer. After his short stretch, he decided to quit the job and collaborate with his university colleague to create Razorpay in the year 2014.

Shashank Kumar – Founder and CTO of Razorpay, a BTech graduate of Computer Science from IIT Roorkee. After completing a 3-month internship program at the University of Minnesota, he joined another internship program provided by Microsoft as a Software Development Engineer. Upon completion of the internship, Kumar joined SDS labs as a Vice President. Afterwards, he joined Microsoft as a Software Development Engineer and served for 2 years before deciding to be part of RazorPay.

How did it all begin?

The idea of creating the startup was initiated when both were serving in well-reputed organizations. During their service, they found out the difficulties faced during financial transactions. They realized how muddled the online payment mechanism was in India. This led them to work on payment problems in India and slowly they changed their tracks.

So they created a user-friendly online payment gateway. To verify the feasibility of their ideas, they conducted market surveys and collected feedback from potential customers. The idea was first initiated at a winter batch of Y-Combinator’s startup in 2015. After quitting their jobs, the founders were supported by the Startup Oasis in Jaipur for setting up Innovation Incubation and Entrepreneurship (CIIE).

Must read: 5+ Powerful Brand Positioning Strategies to Stand Out From Your Competitors

Mathur said, “We realized that most online payment gateways were extremely cumbersome to get started on, especially for startups and small and medium enterprises. When we contacted a few payment gateway companies, we were alsed for our past operational records, security deposits, and high setup fees. Online reviews of most payment gateways in India confirmed similar bad experiences.”

Today, Razropay employees’ strength has grown up to 1750 and is actively hiring more skilled people for various roles.

Popular products of Razorpay:

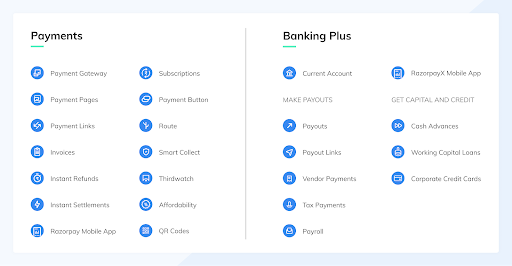

In 2017, Razorpay launched 4 products namely Razorpay Route, Razorpay Smart Collect, Razorpay Invoices, and Razorpay Subscriptions, to handle various tasks like cash inflow, cash disbursement, automated NEFT, collection of scheduled payments, and others. Razorpay Capital was another subsidiary venture of the platform which backs businesses with instant loan facilities.

Must read: What Is Viral Marketing: Viral Marketing Strategies, Techniques and Examples

It introduced 2 new features namely Partial payments (which allows end-users to carry out payments against a certain order ID), Batch uploads (which allows businesses to produce and process links in different batches instead of creating separate links by uploading different files which accommodate the collect order information). Another popular product is Razorpay X which is an AI-driven API banking platform, to facilitate businesses with full working current accounts used for automating payroll, bank transfers, sharing invoices, etc. Another product, Razorpay X Payouts, allows businesses to disburse payments from vendor and customer payouts to the employee salaries.

Another product of the company named RazorPay X Tax Payment Suite, allows businesses to automate the tax payments process by providing aid to compute and pay TDS, GST, and advance tax.

- Razorpay’s Client base – Popular brands like Oyo, CRED, Zomato, Swiggy, Byju’s, Goibibo, Airtel, etc.

- Leading investors of Razorpay are – Tiger Globe, Rabbit capital, Y Combinator, Singapore’s sovereign wealth fund, Matrix Partners, Sequoia India, and others.

- The top competitors of Razorpay are – Instamojo, PayU, Payoneer, GoCardless, ApplePay for merchants, Citrus Pay, etc.

Razorpay business model:

The business model of Razorpay is one of the essential factors that has helped the startup reach heights. According to the model, Razorpay charges a low transaction fee, i.e., 1.99% for credit card subscribers and 2.99% for debit card subscribers, which has to be paid through their payment gateway. This simple process makes the payment gateway attractive to merchants. Razorpay lays down certain transaction charges for domestic and international transactions. For domestic transactions, 2.36% (2% transaction charge + 0.36% GST) and for international transactions (3.54%) for every transaction made through their payment gateway.

Must read: CRED Business Model and How CRED Works | CRED Success Story?

The financial gateway of Razorpay continues to bet on the new software SAAS (Software As A Service) parallel to the company’s launching of new products for merchants and small businesses.

Razorpay Revenue model:

The annual revenue of Razorpay is estimated to be around $145.2 M per year, which has made the company emerge as a unicorn startup of India. As 2021 stats, the digital payment industry of India has reached 4371.18 crores in the financial year 2020-21, which was 1459.02 crores in the FY 2017-18. The company offers a framework for merchants to accept, process, and dispense online payments through its gateway.

Razorpay Business strategies:

Razorpay has mainly 6 strategies for its business.

- PIS (Problem Identification) – The founders found out the fact that bringing multiple payment gateways together is a tough task and next to impossible. Razorpay thus found an opportunity to introduce a common payment platform for all types of businesses. This became user friendly for both customers as well as business owners. The customers had to just enter the amount, select their payment mode and click submit. Transaction between a customer and a business was never so seamless before.

- Payment alarm – Razorpay incorporated an automatic payment reminder system. It asks the business owners to provide a list of customers and the amount to be paid by them on a regular basis. Razorpay then sends reminders to such listed customers through emails, messages, etc. way before the due date, so as to remind the customer to pay their dues. Razorpay constantly keeps sending messages to the default customers till they close their dues.

- Industry adaptability – For an industry to grow, you need to adapt with the changing market trends. Razorpay studied the market and found “subscription strategy” as the latest trend for businesses. Many companies adopted the subscription method to let a customer pay his dues regularly every month. Razorpay also adopted this subscription method in its marketing strategies. It offered the customer to subscribe by paying through different payment gateways like UPI, Credit card, Debit card, etc.

- Banking as a service (BaaS) model/ Neo banking model – The BaaS platform offers software which provides safe transfer of data between a traditional bank and a fintech company. Razorpay thus launched its banking services named Razorpay X. It helps a customer/ business to carry out all banking-related operations like opening an account/borrowing loans/ payrolls, etc through the Razorpay platform. It also provides a Corporate Credit card to the user. Big companies like Dunzo. Zomato, etc. have already started using this credit card for carrying out their banking transactions.

- Lending strategy – Razorpay launched its another product, Razorpay Capital through which they provide business loans to companies. Unlike the lengthy loan processing system of traditional banks, Razorpay does not take much time to lend money to a worthy customer. It just looks at the overall transaction record of the customer and his CIBIL scores. The loan disbursement takes a short span of just 48 hours. Within such a short time, all the loan amount gets transferred to your account inclusive of taxes.

- Dedicated customer service – Razorpay is a user-friendly company and focuses on providing the best services to its customers. It ensures solving customer problems within 12 hours. The company also provides a knowledge-based support system where a customer can find solutions to his problems on his own. The customer has to type his query on the dashboard and suggested answers will get displayed immediately on the screen. This has led to an increase in customer satisfaction.

Incorporation of the above strategies has provided a positive impact on the growth of the company. The company has been growing since its launch.

Services offered by Razorpay:

The Razorpay dashboard has multiple features in it like real-time charts, analytics, which provides assistance to the user to know about his business’s performance. It enables a business to manage its payment gateway account and other products from its payment company. A business can keep a track of its transactions very easily. Razorpay offers great solutions to the user and helps them to grow. It offers financial and banking services to make transactions easy for the business to run effectively.

Marketing strategies of Razorpay:

Razorpay saw a steep increase in the volume of digital transactions from Small and Midsize Businesses (SMBs). Online transactions in Tier 2, 3 cities started growing rapidly. Razorpay thus plans to accelerate this digital revolution by enabling many new Indian SMBs to adopt the digital payment mode in the coming years. With this motive in mind, Razorpay introduced a mixture of payment solutions like MultiQR, Kiosks, Payment Handle, etc. These products were aimed at achieving the digital goals of the company.

- MultiQR – Razorpay has the most rugged QR code solution among its other competitors. You can generate any number of static and dynamic QR codes using MultiQR. You can choose different types of QR codes like UPI QR codes or credit/debit card QR codes, etc. for accepting payments. It also allows the user to generate personalised and unique branded QR codes for his business by incorporating his business name and logo. This promotes cashless transactions for a business.

- Stores – The Razorpay stores provide an end-to-end solution to the customer and help them understand the company policies, create/ set up an online store to carry out transactions. Through online stores, a merchant can customise an eCommerce store and sell his products online. The merchant can even promote his products over social media platforms like Facebook, Instagram, etc.

- Payment handle – It allows the user to create personalised links to accept payments. Users can grab their link on setting up the Razorpay account. Then just share the link with his costumes and receive the payments. Razorpay allows you to personalise your links with your business name and logo to create a unique identity for your business. The customers will have wide options to pay to the merchant.

- Tap on Glass – Enables contactless payments to the merchants through cards. Razorpay is well optimised to run on android and other devices. Tap on Glass is well suited for offline businesses and stores. Using this technique, a merchant can convert his NFC enabled android smartphone into a POS machine to carry out cashless transactions. Razorpay believes in bringing transparency and efficiency to a business.

The pandemic effect:

The company firmly believes that the covid-19 pandemic was an unpleasant experience for many big organizations and has shown some negative faces in the market. Their revenue fell down to 30% in the initial 3 months of the pandemic. But soon after 3 months, the company witnessed a growing interest from small and large businesses to digitalize their finances. The pandemic catalyzed the process of digitalization and led to the rise of many native-digital startups. Within a year, Razorpay processed roughly Rs. 2,93,944 crores in the total payments volume and its overall revenue grew 40% – 45% per month throughout 2020. Along with supporting domestic and individual freelancers, Razorpay also provides its services to international payments gateways in over 100 countries.

Online payments in India saw a growth of around 76% in the last 12 months (report via India Business News – the TOI). Being India’s leading Fintech Unicorn startup, Razorpay announced a 3X growth in its payment volumes over the past 12 months. These whooping digits show the scope of growth for the digital payment industries in the coming years.

Harshil Mathur in a conversation said to Entrepreneur India:

“We saw the Covid -19 pandemic as an opportunity as the digital transformation that would have happened over the next 2-3 years was going to happen over the next 6 months, we had a broad arsenal at our disposal that enabled us to make the opportunistic bets.”

Getting started with Razorpay:

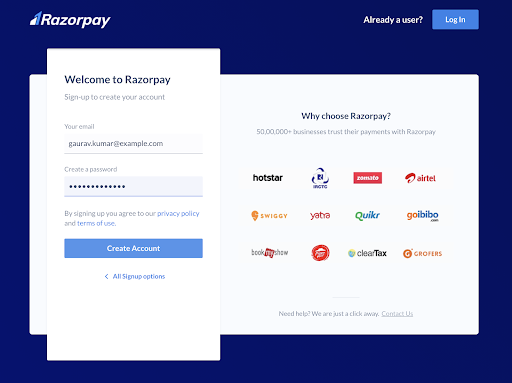

To avail the huge list of benefits, you have to sign up with Razorpay. On signing up, you will get a quick insight into your business performance and transaction history. Steps to follow to activate your Razorpay account:

Must read: Nykaa Business Model & How Nykaa Works?

Razorpay is well optimised to run on computers and mobile devices. For mobile devices, you can download and install the app from Play Store or other iOS Stores.

- Open the app and click on “Create an account”.

- Enter your email address and a password to register.

- Enter your name and other personal details. Enable the option “Get updates on Whatsapp” to receive account updates over your WhatsApp number. You can disable the service whenever you want to stop receiving Whatsapp notifications about your Razorpay account.

- Click “Next”. You will soon receive a verification code.

- Click on the verification code sent to your email address.

- Welcome onboard Razorpay.

Razorpay Future plans:

For the 7-year old startup, the objective remains the same, payments and financial infrastructure, to facilitate businesses to manage their money flow. The newer lines of business launched within 2 years have contributed towards 30% of the overall revenue of the company. Razorpay is looking to foray into the Southeast Asian market with its new payment solutions launched in 2022. Also, the company is looking forward to power crypto-payments in India and is having an eye on the parliament discussions over the matter.

Mathur said, “Definitely we are waiting for how the crypto bills come out and if there are different rules under which the regulators allow it, we would love to support it. The only reason why we have stayed away from it is because there is a grey zone and we do not know what is legal and what is not.”

The company is also planning to invest in Fintech B2B and Software startups and expand them. Razorpay is also planning to hire an additional 500 employees by FY 2021-22.

Currently, different payment gateways are regulated by a few banks and not RBI. Razorpay wanted to build new technologies that would make regulations and compliances more cleaner and transparent. Thus being regulated by the RBI, Razorpay gets clear guidelines on security, KYC norms, account operations, and other payment requirements.

Razorpay plans to use a significant portion of its funds to develop new technologies and enhance its recently developed product suite Razorpay X (neo banking platform) and Razorpay Capital (lending arm).

The company powers more than 170,000 small and large-scale businesses. The company is partnering with banks to build a corporate credit card to offer flexible limit time credit periods and auto-payment for businesses. The credit cards powered by the company’s credit intelligence team can be used to make payments towards Facebook ads, Google ads, AWS, Business Travel, and much more.

Razorpay accomplishments:

- 2016: listed in the Masscom “League of 10 companies”

- 2017: the co-founders got selected for the “Forbes 30 under 30” and won the Bronze award for the best POS innovation by PYMNTS.com, also was a runner-up for “Financial Express Software Product of the Year”

- 2018: awarded by LinkedIn as “India’s 25 most sought-after companies to work for”.

- 2019: IFTA declared Razorpay as the “most innovative payment startup” and was included in the Y Combinator’s list of top 100 organizations.

- Awarded as “most innovative payment start-up” and “most innovative Fintech product” for its neo-banking product Razorpay X.

Final thoughts: Success Story of Razorpay

Today, almost all payment gateways have the choice of selecting Razorpay as their payment platform. You can find various payment gateway platforms in India which allow their clients to make/ accept payments on the internet. Online shopping experience was nurtured by the innovative solutions laid down by Razorpay. The unique strategies of Razorpay have emerged as a successful unicorn startup of India.

FAQs related to Razorpay:

-

What is the transaction limit of Razorpay?

Razorpay allows transactions up to a maximum payment of Rs. 5,00,000/- which can be increased by having a word with their customer service support team.

-

Does Razorpay refund money?

Razorpay refunds the money to the source account only in case of a failed/ incomplete payment.