Top 7 Online Payment Gateways in India

‣ Listen to this article –

India is one of the top nations for online businesses. As the country becomes more tech-savvy, it becomes even more important for entrepreneurs to find the best payment gateway in India. Read on to find out which are the best payment gateways in India when it comes to startups and online businesses.

It can be hard to choose the best one in between the different Indian online payment gateways. Luckily, here is a guide of what you need to know to help decide which one will work best for you. Statista estimates that online payments in India are expected to grow with more than 20% CAGR, amounting to 660 million Indians by 2024. There are extreme opportunities waiting for those who make use of online transactions, due to the potential 1.3 billion people population.

List of 7 Best Online Payment Gateways in India:

1. Razorpay

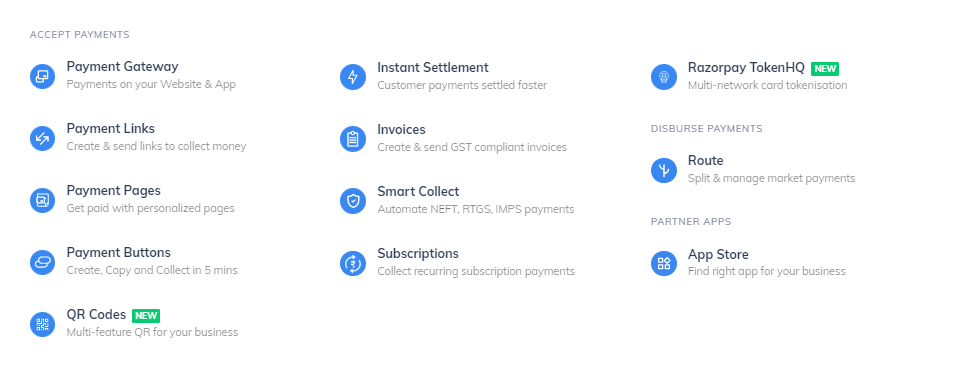

Razorpay is one of the top payment gateway providers in India, with more than 800K customers. The company was founded in 2014 by Shashank Kumar & Harshil Mathur and became a unicorn startup with $1 billion valuations in October 2020. Razorpay also has an easy integration and instant activation specialty. If you desire to use this company’s payment gateway features, you can activate it on your dashboard, which shows real-time data of transactions.

Razorpay is a payment gateway that enables you to accept credit/debit cards, net banking, UPI, and wallets. Unacademy, UrbanClap, Zoomcar, Groffers, BookMyShow are some of the companies that are using Razorpay for their payment gateway.

The digital payment platform also offers you the benefits of managing your marketplace along with the automation of bank transfers. You can also use their services to collect recurring payments, share invoices, and avail working capital loans.

Apart from this, Razorpay offers Razorpay Route API which can split payments among partners or individual accounts for better management of money flow.

Some of the Pros of Razorpay are:

- Free setup cost

- Instant activation

- Easy integration

- API Driven

- 100+ payment modes

- Simple Pricing,

- Best in industry support,

- Real-time Dashboard

- Fully Secure

- Invoice Payments

- Payment Page Build

- Payment Button Build

- Recurring payment

- International transaction

- Payment without redirection

Transaction charges:

- 2% on UPI, wallet, net banking, and Indian debit/credit card

- 3% on International cards, and EMI

2. CCAvenue

Founded in 2001 with more than 200 payment options including 6 credit cards, 58 + bank accounts, and 97+ debit cards, CCAvenue streamlines digital transactions over the web.

It offers a service to integrate on your website as well as through your application. CCAvenue also has a security system that identifies fraud and risk, called FRISK. With air Asia, Lakme India, and Myntra as some of their customers, it is no surprise that this company is so popular and desirable.

With no withdrawal fees, integration options, mobile-friendly design, fraud protections, and interactive language translation services – CCAvenue is all you need in a payment processer!

Some of the Pros of CCAvenue are:

- 200+ payment methods

- Website & App integration

- Mobile payments

- International transaction

- Multiple currency processing

- Invoice payment

- Fraud detection system

- Recurring payments

- 24/7 support

Transaction charges:

- 2% on UPI, wallet, net banking, and Indian debit/credit card

- 3% on International cards, and EMI

- Rupay Debit card: 0.00%

- Multi-currency options: 4.99%

This is also for you Top 10 Industries That Need Digital Marketing to Skyrocket in 2024

3. Cashfree

Founded in 2015, Cashfree is an online payment gateway in India that serves 50,000+ businesses for their payout. Cashfree enables instant refunds and is the leading API banking platform in India that helps businesses to transact money easily. This company allows transactions to be executed securely across industries, offering consumers convenience and transparency.

Cashfree offers split payment solutions and integrates with different well-known brands like Shopify, PayPal, Amazon. It’s used in industries like Zomato, Cred, Puma, Keto, BigBasket, Xiaomi, Dunzo, HDFC ERGO, and so on

Some of the Pros of Cashfree are:

- Free setup cost

- Invoice payment

- Fraud detection

- Easy integration

- Low transaction fee

- High security

- Recurring billing

- Website integration

- Auto collection of payment

- Instant refund

Transaction charges:

- 1.75% on UPI, wallet, net banking, and Indian debit/credit card

- 3.5% + 7 INR per transaction on International cards

- 2.5% on EMI and pay later

4. Instamojo

Instamojo is the easiest way to build your business online, with built-in marketing tools and seamless subscription options. You can find full-stack SME power in Instamojo’s platform, fully supporting 15 lakh+ Indian independent businesses.

Install mojo provides you all the necessary components of eCommerce in one app, including CRM, analytics, payment gateways and inventory management. It also allows you to customize your experience with phone, tablet or desktop setups.

Some of the Pros of Instamojo are:

- Zero setup and maintenance costs

- Free eCommerce store

- Shipping management

- Invoice payment

- Low transaction fee

- Various add ons

Transaction charges:

- 2% + 3 INR on UPI, wallet, net banking, and Indian debit/credit card

- 3% + 3 INR per transaction on International cards

5. PayU

Netherlands-based fin-tech company PayU can work for all your payment needs. PayU guarantees transaction security, simplified account management, risk mitigation, and operating in 17 countries. The company has 100s of online payment methods including net banking, cards, wallets, EMI, UPI, and the buy now – pay later option. Operating business abroad? PayU allows for more than 100 foreign currencies.

PayU is a leading payment gateway for B2B businesses in their respective country. They are partnered with not only start-ups but some of the big players in their countries. A few names of companies who use PayU are Netflix, Airbnb, Dream11, and Ola. The best thing about PayU is that it has an easy-to-use interface for its merchants along with offering a customizable checkout page experience.

Some of the Pros of PayU are:

- Dedicated account manager

- Zero setup cost

- 100+ foreign currency processing

- Invoice payment

- Various add ons

- High security

- Recurring billing

- Website integration

Transaction charges:

- 2% on each transaction

6. Paytm

Paytm is an online payments company that helps businesses across the globe. Paytm’s Payment Gateway allows companies to take payments using domestic issuers, foreign cards, bank accounts, UPI routing, their wallet, and prepaid cards. Unlike other providers, this gateway also works seamlessly with major brands.

The Paytm Payment Gateway has all the features needed for sleek, seamless payments. The Paytm App is designed in such a way that customers of all kinds can easily understand how to make a payment; while paying merchants get top-of-the-line integration with their eCommerce website. Widening its scope beyond one’s bank account balance, the Paytm app also allows for making purchases by accepting UPI payments at zero transaction fee.

It also gives companies using the service access to T+1 settlement. This pays companies like Zomato, Uber, Adani, Jio and Swiggy who join the gateway the fastest possible money.

Some of the Pros of Paytm are:

- Instant activation

- Easy integration

- 100+ payment sources

- Industry-best success rates

- India’s most widely-used checkout

- Dedicated support

- Excellent user-interface

- Faster transactions

- Invoice payment

- Payments without website or app through links

Transaction charges:

- 0% on UPI

- 1.80% + GST Netbanking

- 1.55% + GST on Paytm Wallet

- 1.85% + GST on Credit Card

- 0.4% + GST for amount < 2000, 0.9% + GST for amount > 2000 on Debit Card

- 0% on Rupay Debit Card

- 2.65% on AMEX/International

Top 5 Online B2B Marketplaces in India

7. Paypal

With a global reputation and hundreds of millions of users, Paypal has expanded to more than 200 countries and 325 million active customers. Paypal, among the popular payment gateways in India, can be a good choice for your business. Their software has world-class security for making an online transaction, allowing almost every international credit and debit card, and supporting international currency settlement to withdraw money. You can handle checkout conversion that is 82% higher than other payment methods with the company’s seamless shopping!

Getting started with PayPal can be as easy as signing up for an account, linking your card to PayPal, and done! You can also start transacting IMMEDIATELY thanks to the variety of available options.

With a free return shipping option and buyer protection, Paypal is a popular choice for a company’s online store. Services from PayPal are used by the best names in the industry, like Udemy, MakeMyTrip, ALT Balaji, Gaana, and so on.

Paypal provides a security and compliance system to make your eCommerce experience safe and pleasant. Paypal can connect with any platform without cost, including recurring billing. Your customers’ data is stored through a secure 128-bit SLL encryption with an annual maintenance fee of zero for all of its customers. In addition, the latest version of the Paypal app comes with features such as Android Auto integration and contactless payment using QR codes– making it easier, more secure, and faster than ever to use Pay.

Some of the Pros of PayPal are:

- Instant activation

- Easy integration

- Faster transactions

- Invoice payment

- Fraud protection service

- Allows multiple currencies

- 24/7 customer support

- Recurring payment

- Card details can be saved

- Mobile payments

- Payment using QR code

Transaction charges:

- 5% + 3 INR per transaction

Conclusion:

Having a variety of payment gateways members have the option to choose from can eliminate any inconvenience that they would normally experience. If there are other issues causing customer frustration, then this strategy should be adopted. In conclusion, an online business presence is essential for success and having at least two payments gateways provides ease for your customers to choose from.

hasta la próxima! Muchas gracias.

FAQs related to online payment gateways:

-

What is Payment Gateway?

A payment gateway is a type of application or platform that lets people and businesses receive and make payments online. It also enables the consumer and merchant to securely exchange goods and services via the internet.

-

How to choose the best payment gateway for your startup and business in India?

For any payment gateway, You should consider these points before going to finalize it.

1. Security

2. Support

3. Settlement days

4. Transaction charges

5. User-friendly interface

6. Easy integration -

Which is the Best Online Payment Gateway in India?

This is completely dependent upon your business type and models. however, ForgeFusion recommends Razorpay, which follows all 6 points given above.

-

Which is the cheapest payment gateway in India?

Cashfree is the cheapest payment gateway in India by offering only 1.75% per transaction and no maintenance fee.

-

Which is the free payment gateway in India?

There’s no free payment gateway, but you can save money with the different types of transaction charges.

-

Which are the Top 7 Payment Gateways in India?

Razorpay

CC Avenue

Cashfree

Instamojo

PayU

PayTM

Paypal -

How to integrate a payment gateway to a website?

If you want to add a payment gateway to your website, explore the appropriate method based on the platform type. If using a well-known CMS, connect with your developer to utilize a plugin. If you have a custom code website, you must use another way of integration by using APIs.

List your business for free at ForgeFusion marketplace – Click here