Nithin Kamath Net Worth: Life Story, Age, Education, & Net Worth Breakdown

- Last Updated December 21, 2023

Suraj Shrivastava

Chief Link Building Strategist

Chief Link Building Strategist

Isn’t it fascinating that a company with no debt and zero funding, bootstrapped, started all by itself is now a billion-dollar company in such a short period of time? In this article, we are going to know about the man and mind behind the idea, who made it all possible, co-founder and CEO of the online stock brokerage platform Zerodha, Nithin Kamath.

In addition, he has also founded True Beacon and Rainmeter, two financial businesses. Since the age of 17, Nithin Kamath has been a successful full-time trader. Trading has brought him millions of dollars. He is just 41 and one of India’s youngest billionaires with a net worth of $2.6 billion by 2022.

Nithin Kamath, the CEO of Zerodha, and his family have seen their wealth increase 51% to INR 25,600 crore during the year 21-22. A record number of individual investors opened trading accounts during this time period to start investing in stocks. According to the IIFL Wealth Hurun India Rich List 2021, the Kamath family is currently India’s 63rd richest family.

According to the wealthy list, the Kamath brothers are wealthier than Rakesh Jhunjhunwala, the richest individual investor in India, whose holdings were recently valued at INR 22,300 crore. Nikhil Kamath, Kamath’s younger brother, is worth INR 11,000 crore.

| Full Name | Nithin Kamath |

| Date of birth | 5 October 1979 |

| Occupation | CEO, Zerodha |

| Education | Degree from the Bangalore Institute of Technology (Electronics Telecommunications) |

| Marital status | Married |

| Mother’s Name | Revathi Kamath |

| Father’s Name | U.R Kamath |

| Wife’s Name | Seema Patil |

| Child | Kiaan Kamath (son) |

| Siblings | Nikhil Kamath (Younger brother) |

| Birth Place | Shivamogga, Karnataka |

| Net Worth | Approx. $2 billion as of FY22 |

| Zodiac sign | Libra |

Nithin Kamath is 42 years old as of 2022, born on 5 October 1979. He began investing at the age of 17 by managing his father’s trading account. He was doing well in trading up to the age of 22, but the 2001 market crash cost him his cash, and he even took a job at a contact centre to get some money to return to the stock market.

He launched Zerodha at the age of 31, and the rest is history. His company is now the #1 brokerage firm in India in terms of volume.

Nithin Kamath was born to a Konkani family in the Indian city of Shivamogga, Karnataka. U.R. Kamath, his father, worked for Canara Bank as an executive. He learned how to play the vena from his mother, Revathi.

Also, a co-founder at Zerodha is his younger brother, Nikhil Kamath. Seema Patil is Nithin Kamath’s spouse whom he met while he was working in a call centre, and the two were wed in 2008. Basketball is his favourite sport. A son named Kiaan was also a blessing for the couple.

Nithin Kamath finished both his school and college education in Bangalore in 1996. He earned a degree in Electronics Telecommunications from the Bangalore Institute of Technology. His Marwari buddies advised him to engage in the stock market while he was still in college. He began dealing with his father’s trading accounts at the young age of 17 as a result.

Nithin Kamath was reared in Bengaluru by a veena instructor mother and a Canara Bank manager father. Nithin Kamath was born into a Konkani household in Shivamogga. Nithin Kamath was introduced to stock broking for the first time at the age of 17 while growing up in a neighbourhood where there were many active merchants.

He was really intrigued by the entire stock trading system and quickly discovered that he shared its enthusiasm. Since then, he has been trading regularly, and he has done so throughout his time at the Bangalore Institute of Technology. By the time he received his degree, he had made a sizable profit.

Then, though, things started to go wrong. He had borrowed money to trade with, but he lost a lot of money as a result of blowing his trading account. He started working in a contact centre for four years while still trading throughout the day to pay off the debt. Nithin Kamath claims on his website that he resigned from his work after meeting the first individual who wanted him to handle their portfolio.

Nithin Kamath quit his call centre job after landing his first client. Following that, he persisted in working hard on his interest, and in a matter of months, he acquired 10 clients. But he found it challenging to manage 10 Clients. He then made the decision to work as a sub-broker with Reliance Money, where he later discovered several flaws.

He started a professional advising company by becoming a franchisee of the brokerage firm Reliance Money in 2006. His brother Nikhil, who Nithin Kamath asserts is a greater trader than he was, joined him at about this time.

Nithin Kamath reasoned that he could set aside some time to create the brokerage company they want while Nikhil handled trading. Several people suffered significant losses when the markets fell in 2008, but Nithin Kamath made some money. The brothers finally took the jump and founded Zerodha in 2010.

Prior to founding Zerodha, he worked for 12 brokerage firms, all of which employed Old School practices. Additionally, the site’s organizational structure wasn’t very user-friendly, which is why new users are cautious to trade in the stock market.

Nithin Kamath also maintains a blog in the area of investments where he regularly solicits reader feedback on any issues they are having with their brokerage house. The majority of respondents said that even when they engage in large-volume trading, their brokerage firms charge substantial transaction costs.

Nithin Kamath saw an opportunity where they might lower the transaction costs by omitting the functionality of stock advice. The majority of brokerage companies offer tools that encourage consumers to purchase stocks that their specialists have analyzed. In order to lower the transaction fees, Zerodha entered the market by putting the Expert’s remuneration on the table.

When Nithin Kamath recognized the need for a platform that provided users with a flawless trading experience, the idea for the firm was born. Additionally, he thought that individuals required a platform to inform them of the various investing alternatives available.

In contrast to the excessive percentage costs that were typical at the time, Nithin Kamathclaims that with Zerodha, “we were the first to adopt a flat fee model (a maximum of 20 per trade), allowing traders to save up to 90% of brokerage expenses. In addition, we provided this one-price plan to all of our customers, in contrast to the then-dominant businesses that had multiple, opaque packages for distinct clientele. While we were starting from scratch, this openness gradually brought us to notice in online forums and through word of mouth”.

In August 2010, Nithin Kamath and his younger brother Nikhil established Zerodha. In Sanskrit, the words “Zero” and “Rodha” indicate “No boundaries,” respectively. A trading company called Zerodha gained a lot of popularity by educating individuals about the catalyst change in the stock market.

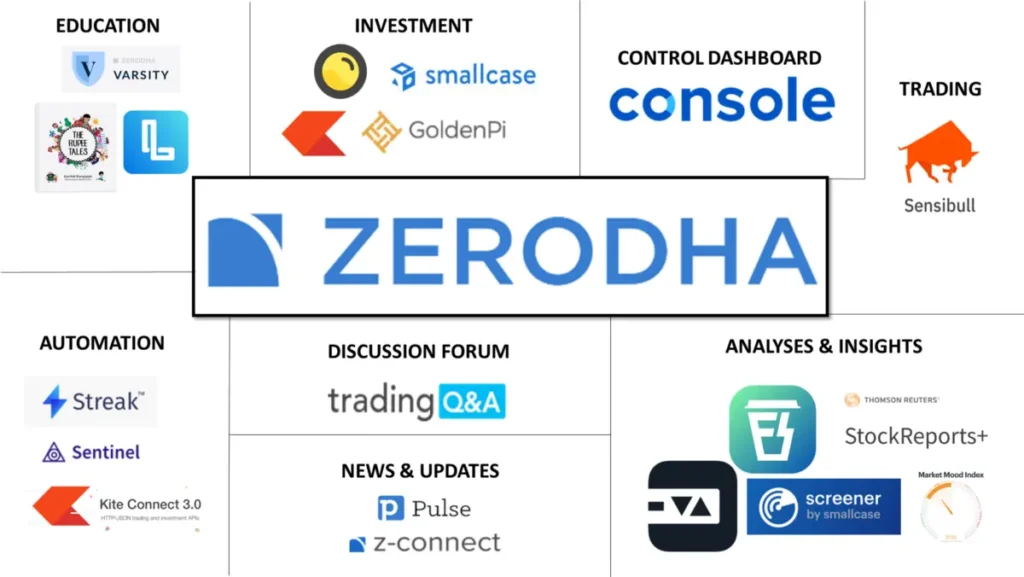

With over 22 lahks active and three million active users daily, Zerodha is the largest brokerage in India for active retail clients because of its unique pricing strategy and in-house technology.

For the purpose of educating young investors who are making their first investment, the Zerodha firm also released a learning module called “Varisty.” Additionally, he created Rainmetter, a 2015 financial technology incubator and start-up fund with a paid-up capital of INR 10 lakh.

Nithin, who has a growth mentality, co-founded an investment management company with his wealthy brother that uses a zero-free business model.

Along with his brother Nikhil Kamath, Nithin Kamath founded the fintech startup Rainmatter, which is growing its brokerage firm. A platform for startup founders and incubators is called Rainmatter.

Nithin Kamath also runs a service market for strategic investors, advice for portfolios and customised programmes, and an investment management company called “True Beacon.”

Zerodha’s business strategy is based on a “Low margin and high volume approach.” Due to the extremely low transaction fees charged by Zerodha, there is typically a significant volume of trading. For Zerodha, this fee collection of lesser sums from a greater number of clients results in strong income creation. Operational costs are another element that helps the organization achieve large profit margins. Compared to some of the top brokers, they are fairly cheap for Zerodha because of its online structure, which enables it to keep minimal operational costs.

The SEBI (Securities and Exchange Board of India) has given Zerodha permission to offer mutual fund services. In February 2021, the firm submitted an application for the related license.

The business, Zerodha is valued at $2 billion (Rs 15,612 crores) in FY22. And The richest person on the “IIFL Wealth Hurun India 40 & Under Self-Made Rich List 2022″ are Nithin Kamath and Nikhil Kamath, creator of Zerodha, with a net worth of $3.45 billion (Rs 17,500 crores) as of FY22.

“As the owner and promoter of any firm, you have two options: either you may accept cash as a wage, which is incredibly inefficient in terms of taxes, or you can sell stock in your business. We have no intention of selling Zerodha holdings. We plan to continue operating solely on our own resources. Therefore, the only alternative means to withdraw money from the company is through pay” once said, Nithin Kamath.

Co-founders have been granted the authority to take up to a certain sum in the event that it is necessary. The resolution’s stated top limit may not match the actual compensation. Compensation of up to INR 100 crore annually is taken by Nithin Kamath in the year 22.

The firm run by Nithin Kamath and Nikhil Kamath had recorded revenues of INR 938.4 crore in FY20, which nearly quadrupled to INR 2,729 crore in FY21. During FY22, when Zerodha reported having generated INR 4300 crore ($562.74 million) in revenue, this revenue saw a good increase once more.

Due to the many new users that joined the firm during the same fiscal year, its income increased in FY22.

Over the past three fiscal years, the company’s profits have also improved. Zerodha reported a profit of INR 424 crore in FY20; this figure more than doubled to INR 1122 crore in FY21 and increased once again to INR 1800 crore ($2 billion) in FY22. Zerodha’s growth is predicted to increase by 60% year over year in FY25.

Additionally, the company’s active users increased by about two times annually. The firm had 1.4 million active users in FY20, which increased to 3.6 million in FY21, and then again to 6.2 million in FY22.

Both Zerodha’s operational revenue and total costs grew. In FY20, it was worth INR. 517.70 crores, and in FY21, it was worth INR. 1260.20 crores.

Zerodha made 81.5% of its operating income from the “selling of service,” which included brokerage fees, sales of high-end tech solutions like the Kite Connect API, management of collections through user onboarding, and trading of transaction fees that customers pay to various stock exchanges.

This income, which was estimated at INR 718.4 crore in FY20, rise by 3.1X in FY21 to reach INR 2,252.5 crore. The remaining 17.5% of Zerodha’s operational revenues are shown under “Other Miscellaneous Operating Revenues.” The company’s interest fees on financial instruments and the margin interest from its customers have made this possible.

Additionally, this revenue stream increased from INR 220.05 crore in FY20 to INR 476.4 crore in FY21, or around 2.2X. According to NSE statistics released on February 14, 2022, Zerodha started with a total customer base of 16 lakhs, which increased to 33.91 lakhs.

The growth of Nithin Kamath’s Zerodha, India’s largest brokerage house, provides an illuminating tale in a time when every business is vying for unicorn status. What was once a bootstrapped business is now valued at $2 billion (INR 15,612 crores). The tale of Nithin Kamath and Zerodha serves as an illustration of how creativity and foresight can result in one of the greatest success tales.

Suraj Shrivastava at ForgeFusion shares simple, effective ways to grow your business using SEO, content marketing, and AI, learned from helping over 50 companies. When he's not working, he loves teaching others or watching documentaries.