In this article, you’ll learn about the process of establishing a startup in India, including the eligibility criteria, the registration steps, the benefits and registration process for the Startup India Scheme and MSME, how to acquire DPIIT accreditation, and the support you can receive after incorporating your startup.

Over the last few years, there has been a first-rate trend taking place in India wherein people are transferring out from their job scene and diving into building their own startups.

Some of these startups are hitting the jackpot, at the same time as others face challenges. But you know what? The spirit of those new startups in India is unstoppable.

In reaction to this environment in the country, the Indian government has begun helping Indian startups with new schemes like Startup India Scheme, and so forth.

But here’s the catch: to avail of these benefits to your startup, you want to first register a startup in India.

If you’re curious to know how to register a startup in India, you’ve landed on the perfect page. Get ready for a step-by-step guide that’ll make the process of company registration for startups a cakewalk.

Let’s go.

What is a startup?

So, a startup is basically a company that is just beginning out and taking up a few massive risks.

These styles of companies pop up when the people behind identify problems in the current system they have been dealing with and think “Hey, we can solve this by starting our own company”.

It is a company that is founded by one or more entrepreneurs and is all about innovation. Well, you see, the beauty of a startup lies in its knack for bringing out new ideas and solving problems!

How to register a startup company in India (Incorporate your business)

When it comes to starting your business in India, you’ve got two options for business planning.

The most popular are:

Private Limited Company – This is a great option where your business is privately owned by a group of people. A “limited” share means that the owner’s liability is limited to the amount invested. So, you don’t need to insist on losing more than you put in.

Limited Liability Partnership – Now, this is a combination of a company and partnership. Sounds like you got the best of both worlds! Partners in an LLP are not personally responsible for the debts of the business. So even if things go south, their personal assets are protected.

Don’t worry if you don’t know which structure to go for! Check out our blog on different types of legal structures for a better understanding.

For now, let’s focus on registering a Private limited company for now. It’s a popular choice, and I’ve got your page with the step-by-step process. So, let’s go.

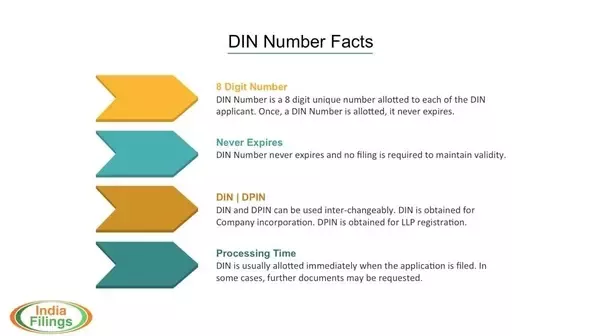

Step 1: Obtain a DIN

So, the Direct Identification Number (DIN) is an 8-digit number that every director of a private limited company must obtain.

You can apply for a DIN on the Ministry of Corporate Affairs (MCA) website, where you’ll get all the information related to it and how to apply.

Step 2: Digital Signature Certificate (DSC)

So, the DSC is a secure electronic certificate used for signing digital documents.

You can get the DSC from government-approved certified authorities. Certifying Authority means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT Act 2000.

Step 3: Choose a name

Before you go for the next step, you must first give your business a unique name, a name that is not taken yet.

You can check the availability of your desired name on the Ministry of Corporate Affairs (MCA) website by filing the RUN (Reserve Unique Name) form.

Step 4: Documentation required

- Memorandum of Association (MoA) – MoA is a document that includes the objectives and details of your company such as company name, office address, capital structure, and company goals.

- Articles of Association (AoA) – This document explains the rules and regulations, the rights and duties of shareholders and directors, and how the dividend is distributed.

- PAN card of directors and shareholders

- Proof of address of directors and shareholders

- Specimen Signature

Step 5: Incorporation filing

Now, it’s time to prepare and file all incorporation documents online with the Registrar of Companies (RoC) through the MCA portal.

Fill out the SPICe (Simplified Proforma for Incorporating Company Electronically) form, which combines several forms and declarations.

Next attach the required documents such as MoA, and AoA, and pay the fees.

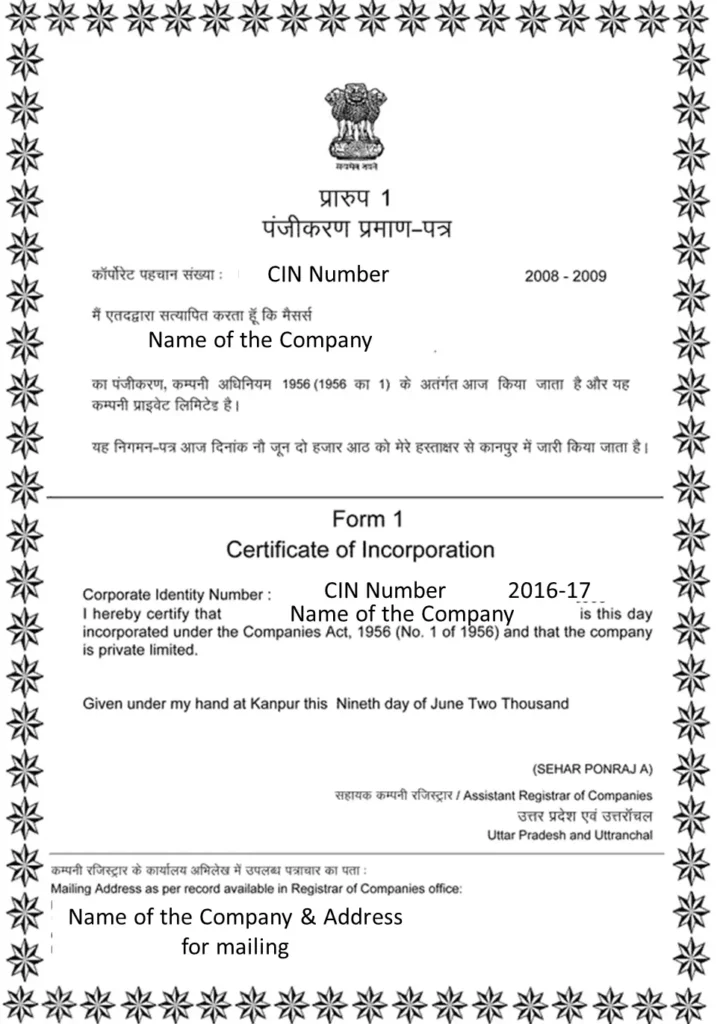

Step 6: Get the Certificate of Incorporation (COI)

Once your documents are verified you’ll be given the certificate of incorporation which will be proof of your company’s existence.

It includes details like the company’s name, registration number, date of incorporation, and CIN (Corporate Identification Number).

Step 7: PAN and TAN

Then, you can apply for Permanent Account Number (PAN) and Tax Account Number (TAN) that is issued through the Income Tax Department website.

Step 8: Open a bank account

Finally, open a bank account in the name of your company to carry out the financial transactions of your company.

Startup India Scheme

The Startup India Scheme is like a breath of fresh air, developed by our Prime Minister Narendra Modi and the Government of India.

It all started on January 16, 2016, with one mission in mind – to give startups in India the ultimate support and encouragement they need. The aim is to introduce new products and services that make our lives a breeze and increase employment opportunities across the country.

Further, it’s like the golden ticket to entrepreneurial success. They have access to endless resources, advice and opportunities to rock the startup world.

Benefits of the Startup India scheme

Now let us talk about some of the benefits of the Startup India scheme.

1. Funding support

You see, one of the biggest challenges for startups in India is not having sufficient funds. Meaning, most of the time the only thing startups lack is sufficient funds.

The Startup India scheme solves this problem by giving startups access to an ocean of funding opportunities after registering on the platform.

2. Simplified regulatory compliance

Do you know what’s another real pain for startups in India? Regulatory compliance. The procedures and paperwork can be such a headache and a major barrier to entry.

But guess what? The Startup India Scheme helps startups simplify all those complex compliance issues and make their process easier.

Through a single online portal, startups can now register their business, file for patents, and obtain various other approvals.

3. Networking and collaboration opportunities

Networking and collaborating with others is like the secret sauce for entrepreneurs. And guess what else? The Startup India Scheme has got our back!

They offer some fantastic opportunities to connect with people interested in startups. One such is the Startup India Global Venture Capital Summit. It’s like a gold mine where we can pitch our ideas to potential investors and maybe even get our next big break.

The program also connects us with incubators and accelerators.

4. Skill development

A skilled workforce is all you need for a startup to succeed.

The Startup India scheme gives you access to various training and mentoring programs like the Atal Innovation Mission to develop your skills.

5. Global Exposure and Recognition

Finally, you also need your startup to be recognized globally so that you can attract investors, customers, and talent from all over the world.

The scheme gives you access to multiple international events and summits like the Global Entrepreneurship Summit, where you can connect with investors and other startups worldwide.

Eligibility Criteria for Startups

Now let’s talk about some of the eligibility criteria for registering a startup in India.

Entity type

So the first and most important criteria to meet to qualify for Startup India is that your company must be a Private limited company, a partnership firm, or a limited liability partnership (LLP).

Startup age

Next, if you want your startup to be eligible for registration under the Startup India initiative, it should be a relatively young one. By that, I mean it should have been incorporated less than 10 years ago from the date you’re applying.

Turnover limit

Now, there’s also a turnover limit for your startup to keep in mind. If you want to register, your Startup’s annual turnover must not go beyond INR 100 crores in any of the previous financial years.

Innovative and scalable

What’s more? If you want your startup to be eligible for registration under the Startup India initiative, you gotta bring the innovation and scalability factor to the table. Meaning, your business should be all about creating, improving, or inventing products, processes, or services that have the potential to go big and make a splash in the market.

Original entity

The next rule for registering a startup in India under this scheme is that – The entity shouldn’t have come into existence by splitting up or reconstructing an already existing business. In simple terms, it means that the startup should be a fresh, independent venture and not a result of breaking up or reshaping an existing business.

Certification

Your startup needs to obtain a recommendation letter or a letter of support from a recognized incubator approved by the Government of India.

Register with Startup India

To officially register a startup in India, you’ll need to hop onto the Startup India website. It’s super simple, and everything happens online, so no need to worry about paperwork and long queues.

Step 1: Visit the Startup India website and take a look at its ‘register’ button. Once you find it, click on it.

Step 2: Then, you will be asked for some basic information for your startup profile. Just enter your name, email ID, and mobile number and choose a password. Click that ‘Register’ button, and you’re off to a good start!

Step 3: Next, check your email because an OTP (one-time password) will be sent to verify your email address. Just fill it in, and it’s time to fill in a few more details.

Step 4: They’ll want to know what user type you are, the name of your startup, and what stage it’s currently in and once you’ve covered all that, hit ‘Submit’. After that, all you can do is wait for them to review and verify your profile. Once it’s verified, voila! Your Startup India profile will be officially active.

Now that you are a part of the Startup India community, the doors are wide open for you. You can ask for all kinds of cool stuff, like acceleration, incubator programs, mentoring opportunities, and even fun challenges.

Plus, they have lots of resources waiting for you. Think learning and development programs, access to government programs, state policies for start-ups, and even pro bono.

Lastly, with this, you’ll also get DPIIT recognition which will get your hands on amazing entrepreneurs benefits like:

- Relaxed public procurement norms

- self-certification for labor and environmental laws

- Easy company wind-up

- Chance at the Fund of Funds

- Tax exemption for three years in a row

MSME

So MSME stands for Micro, Small, and Medium Enterprises. It refers to all the small businesses operating on a smaller scale compared to large corporations.

Even these enterprises play a really big role in contributing to the Indian economy.

In India, we have the Ministry of Micro, Small, and Medium Enterprises for making and enforcing all the rules and regulations for micro, small, and medium businesses in India.

Benefits of MSME

Let’s learn what are all the benefits of registering an MSME in India.

1. Bank loans (collateral free)

The government has made it easier for small and medium-sized businesses to get credit without having to provide collateral.

Now, both existing and new enterprises in the micro and small sectors can benefit from this initiative. It’s a game-changer because it guarantees funds for these businesses.

2. Reduction in rate of interest from Banks

You see, banks understand the importance of supporting small businesses.

Therefore, if you register your business as an MSME, you can actually get a sweet deal on the interest rates offered by banks. Yeah, it’s true!

MSMEs are given priority when it comes to credit, and that means they get to enjoy a reduced rate of interest on their business loans.

3. Protection against deferred payments

Did you know that when a person buys something from a registered MSME, there’s protection against delayed payments? So, here’s the deal: a customer has to pay up on or before the agreed payment date or within 15 days of receiving the goods from a registered MSME.

Further, if the customer ends up delaying the payment for more than 45 days after accepting the products or services, he’ll have to pay some interest on the agreed price.

4. Concession in electricity bill

After you get an MSME Registration Certificate, you become eligible for one more amazing perk – a concession on your electricity bills.

Imagine being able to increase your production, take on more orders, and expand without stressing about the costs of energy and servicing.

That’s what you get with your MSME Registration.

5. Subsidy on Patent registration

What’s more? If you get your business registered with the MSME ministry you can actually get a sweet 50% subsidy on your patent registration fees. Yeah, you heard that right!

The government wants to encourage small businesses to keep pushing the boundaries of innovation and come up with cool new projects and technologies.

Who is eligible for MSME registration?

Any entity falling under the Micro, Small, and Medium Enterprises (MSME) classification can apply for MSME registration. But here’s the catch: individuals can’t apply for MSME registration themselves. It’s open to businesses like proprietorships, partnership firms, companies, trusts, and societies.

If your business has an investment below Rs.50 crore and an annual turnover below Rs.250 crore, you’re eligible to apply for MSME registration.

Documents required for MSME registration

- Aadhar number

- PAN number

- Address of the business

- Bank account number

- The basic business activity

- NIC 2-digit code

- Investment details (Plant/equipment details)

- Turnover details (as per new MSME definition)

- Partnership deed

- Sales and purchase bill copies

- Copies of licenses and bills of purchased machinery

How to register MSME

So, if you want to avail those amazing benefits offered by the government for MSMEs, you gotta register your business on the ‘Udyog Aadhaar Memorandum (UAM) portal.’ Don’t worry, it’s super simple and free.

Let me break down the steps for you:

Step 1: First things first, head on over to the Udyam Registration Portal. That’s where all the process will happen.

Step 2: Now, if you’re registering your business as an MSME for the first time, click on the first link you see on the page. It’ll get the ball rolling.

Step 3: Time to enter your Aadhaar Number and Name. Once you’re done, hit that ‘Validate & Generate OTP’ button and let the system work its magic.

Step 4: Verification time. Now you gotta fill in those PAN details. No worries even if you don’t have a PAN card yet, just select the No option.

Step 5: Alright, now you’ll need to fill out the form now. It’s just a bunch of details about your business. Take your time and fill it up accurately.

Step 6: Almost there! At the end of the form, they’ll send you another OTP request on your phone. Enter that OTP along with the verification code, and voila! Form submitted.

Step 7: After successful registration, you’ll be greeted with a “Thank You” message and a shiny Registration Number. Keep it safe for future reference.

Step 8: Just a heads up, it usually takes around 2-3 days for the approval and registration process to be completed.

Step 9: Once your application gets approved, you’ll officially be registered, and the cherry on top? They’ll send you the coveted MSME certificate right to your email.

Other Perks and Support

Okay, folks, we’ve covered some major steps for startup company registration for startups in India, but there’s more to add to the list! Let’s dive into some other areas where the government is lending a helping hand.

Funding: We all know it can be a struggle for startups, especially when investors are hesitant due to the risky nature of new ventures.

But fear not! The government has gone ahead and created this nifty fund, loaded with a decent stash of cash—INR 2,500 crore to start things off, and a whopping total of INR 10,000 crore spread across four years (that’s INR 2,500 crore per year). The fund acts as a “Fund of Funds,” meaning it doesn’t directly invest in startups. Instead, it participates in the capital of SEBI registered Venture Funds.

Tax Exemption: Startups get a fantastic perk—they are completely exempt from income tax for 3 years. But hold on, there’s a small catch. To enjoy this awesome benefit, you need to get certified by the Inter-Ministerial Board (IMB).

So, if you’ve incorporated your startup on or after April 1st, 2016, you can apply for this sweet income tax exemption and keep more money in your pocket.

Patents, Trademarks, and Design Registration: When it comes to protecting your innovations with patents and trademarks, the government has got your back.

They’ve got a handy list of facilitators you can approach for assistance. The best part? You only have to pay the statutory fees, which means you get a whopping 80% reduction in fees. Now, that’s a good deal!

Self Certification Under Employment and Labour Laws: Nobody likes drowning in paperwork and compliance hassles, especially when you’re trying to focus on building your business from scratch. Well, the government has come up with a solution.

Startups can now self-certify under six labor laws and three environment laws for a sweet period of 3 to 5 years from their date of incorporation.

FAQs on startup company registration for startups in India

-

Can a one-person company register under Startup India?

Yes. One-person companies can register under Startup India.

-

Can a foreign company register under the Startup India hub?

Absolutely! So any foreign startups with at least one registered office in India can now sign up on the startup India hub now. Good news is that the government is working on expanding the registration process to include stakeholders from the global ecosystem.

-

What are the benefits of Startup India?

Here are some benefits you’ll get after registering a startup in India:

Tax exemption

Cheaper patents

Access to funding

Easy exit

Meet other entrepreneurs

Conclusion: how to register a startup in India

So this was our complete guide on how to register startup in India. You see, fhe government has now started lending a helping hand to all the startups in the ways mentioned above, and that’s really great.

So, folks, by now you might have realized how incredible these opportunities are. It’s your turn to benefit from the government’s support and help you startup go beyond its limits.