BharatPe is an Indian fintech company. That provides a single platform for various digital payments. It focuses on small merchants and Kirana store owners in India.

It provides solutions for UPI payments, card acceptance, small business funding, and others. It helps small merchants to carry out transactions through UPI (Unified Payments Interface) for free using QR Codes.

Much before the establishment of this company, most companies were having a closed ecosystem, where the merchants had to use different QR Codes to receive payments through different payment gateways.

Every payment gateway used to charge more than 1% of the commission. The merchants and SMEs accepted payments by paying some commission, which had become a great problem.

So BharatPe founders thought of addressing this problem and providing a single QR Code for different payment gateways like Paytm, PhonePe, Google Pay, BHIM, and 150+ other UPIs, without any commission.

About BharatPe:

- Sector: Fintech

- Founder: Ashneer Grover and Shashvat Nakrani

- Year of establishment: April 2018

- Headquarters: New Delhi

- CEO: Suhail Sameer

- Website: www.bharatpe.com

- Legal name: Resilient Innovations Pvt. Ltd.

- Tagline: “Ab se Dukandar is king” and “Apne Parivar Aur Shop Ko Rakho Insured”

- BharatPe has launched India’s first UPI “ Bahi Khata” for merchants and SMEs.

Establishment of BharatPe:

BharatPe is a QR code-based payment app for merchants, Kirana store owners, and SMEs. The app allows the user to accept UPI payments. Through a single QR code of BharatPe without any commission. The app also facilitates easy card acceptance and small business financing. Bharat even offers loans to the merchants up to Rs.7 lacs which the merchant can avail of for 3-12 months.

The BharatPe app allows a quick sign-in procedure. And an instant receipt of funds into the bank account of the user. The merchant repays the loan amount in easy installments. BharatPe processes loans worth Rs. 300 crore every month. It has plans to launch secured lending products for merchants, like gold loans and auto loans.

Founders and the team:

- Founders – Bhavik Koladiya, Ashneer Grover, Shashvat Mansukbhai Nakrani

- CEO(Chief Executive Officer) – Suhail Sameer

- CRO(Chief Revenue Officer) – Nishit Sharma

- CBO(Chief Business Officer) – Nishant Jain

- CMO(Chief Marketing Officer) – Parth Joshi

NOTE: With the resignation of Ashneer Grover on February 28, 2022, BharatPe lists Bhavik Koladiya and Shashvat Nakrani as its co-founders.

Ashneer Grover:

Full name: Ashneer Grover

Till his resignation on 28 February 2022, he served as the MD and co-founder of BharatPe. He holds a BTech degree in Civil Engineering from IIT Delhi and an MBA degree from IIM Ahmedabad. Hailing from South Delhi, he headed Corp Dev from Amex India. He also served as the CFO of Grofers, an instant delivery service provider. He features in the Indian show “Shark Tank India” like a shark and gets paid Rs. 10 lakh per episode.

Bhavik Koladiya:

Full name: Bhavikkumar H.Koladiya (Nickname: Bob Patel)

He is the co-founder and Group Head of The Product and Technology area of BharatPe. He is an “Angel Investor” in many popular IT companies in India. Like Pristyn Care, Digifin, and LenDenClub. In March 2022, both the co-founders of BharatPe came into news channels. For fighting for their stake in the company.

Shashvat Nakrani:

Full name: Shashvat Nakrani

He holds a bachelor’s degree in Textile Technology. From India’s premier institute IIT Delhi. He completed his schooling from his father’s institute in Bhavnagar, Gujarat. During his college days, he dropped out of his college in 2018. To start the UPI payment service provider, BharatPe. Shashvat Nakrani is one of the co-founders of the company. He was also named as the “youngest richest self-made individual” on IIFL Wealth Hurun India Rich List 2021.

BharatPe case study:

In 2018, the two co-founders Shashvat Nakrani and Bhavik Koladiya discovered a gap in the digital payment market. The gap was the use of various QR codes by a retailer to make a digital payment.

For instance, if the retailer has a QR code for PayTm but you want to make a payment through PhonePe then you can not make the digital payment as the shopkeeper doesn’t have a QR code for PhonePe.

Before the launch of BharatPe, other payment merchant companies charged 1.5% interest on each transaction. This way the shopkeepers could not earn much profit.

So Shashvat Nakrani and Bhavik Koladiya went to Ashneer Grover for some funds. Ashneer Grover liked the ideas of the two IITians and decided to fund the launch of BharatPe.

Thus BharatPe provided a single QR code for many digital payment merchants. The merchants need not pay any commission anymore. Thus merchants joined BharatPe to stay away from paying transaction commissions. BharatPe even introduced a single-day settlement of transactions for the merchants.

To earn a good profit, the company used its Artificial Intelligence Systems. It noticed that many businesses run through huge cash intake but low-profit margins. They also found that small businesses sometimes need to take loans of less value. Which they cannot take from banks.

To solve this problem, BharatPe introduced a Merchant Lending System. Which offered merchants to take short-term loans for their operations without any collateral.

BharatPe could gather a lot of data when a merchant received a payment through Google Pay, PhonePe, and others. Using the data, BharatPe gets knowledge about the cash flow of the merchant.

Depending on the loan repayment capacity of the company, BharatPe offers a 2% interest rate on the loan provided. Ashneer Grover has made BharatPe skyrocket. The company processes loans of more than Rs. 300 crores per month. As a result, BharatPe emerged as India’s powerful payment merchant platform.

Read – [2022] BoAt Case Study: Marketing Strategy & Success Story of BoAt

BharatPe marketing strategies:

BharatPe follows a unique marketing strategy that has helped the company reach skyrocket. Before the establishment of the company, other UPI payment platforms focused on consumers and customers.

The consumer is the buyer (generally a youth) and the customer is the QR Code which acts as a support system. So the platform had to target two different entities and had to provide cashback to two different entities. Whereas, for BharatPe its customers were its consumers. Its consumer is the merchant. Thus the company decided to provide cashback to the merchant himself.

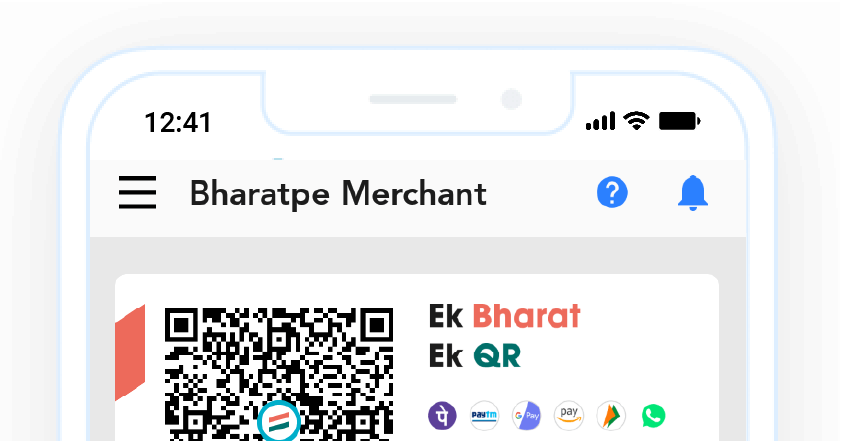

The unique marketing strategy of the company led to two popular campaigns. They were “Ek Bharat Ek QR” and “Team BharatPe”.

BharatPe decided to select only crickets for its brand ambassadors. The makers of the campaign “Team BharatPe” realized that the cricket industry has a huge fan following.

They also found that the retail shops run cricket over their television screens. So they understood that their target audience is cricket-oriented.

The company created a priority in the minds of the merchant as well as the customers to prefer BharatPe over other digital payment platforms.

The other campaign “Ek Bharat Ek QR” gained a lot of popularity too. BharatPe assured the merchant and retailer that payments made through UPI payment gateways will reach their bank accounts Including attractive cashback.

During the pandemic lockdown, small businesses suffered great losses. After lockdown, when retailers were being asked to open up, they needed small loans which banks generally deny due to lack of collateral. With help of BharatPe, the SMEs and retail shop owners could take loans without any collateral and run their businesses again.

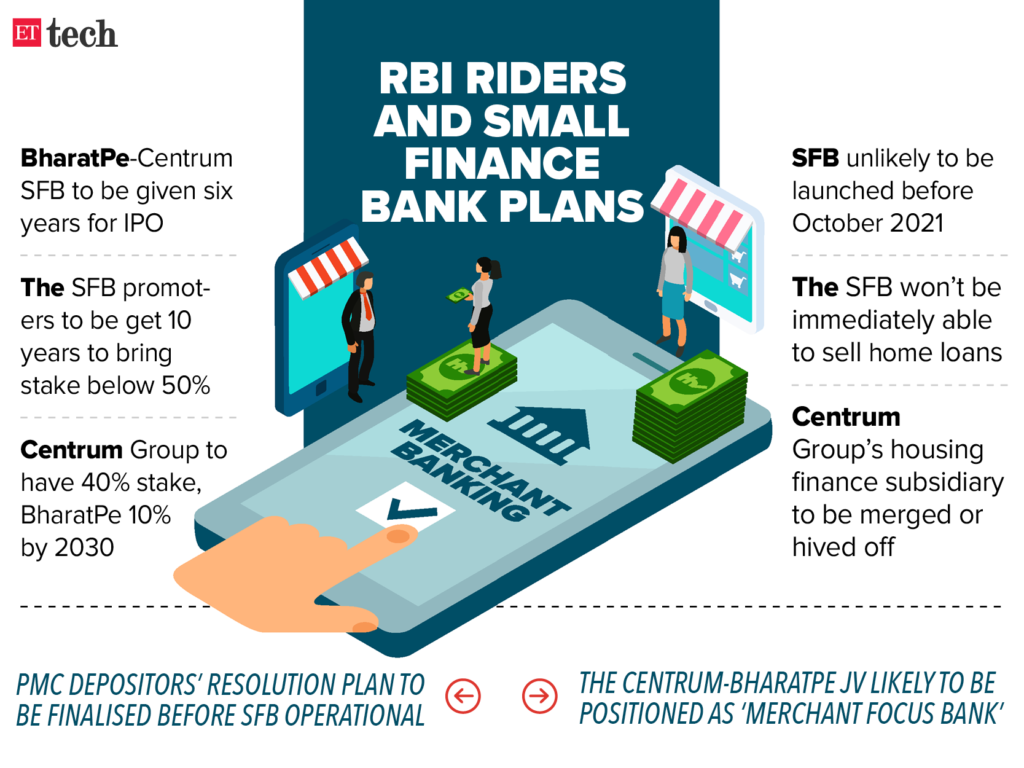

This unique marketing strategy has helped the company reach sky high. They have plans to open up their payment bank for which RBI has already approved the license.

BharatPe Business model:

BharatPe is a B2B QR code-based payments company. The company provides a single QR code. To carry out payments from various platforms like Mobikwik, Amazon Pay, Google Pay, Freecharge, True Caller, and many more.

The retailers receive credits for transactions made into their bank accounts. BharatPe appointed many brand ambassadors from different industries. Let’s see multiple digital products provided by BharatPe.

- BharatPe business app – The app allows a customer to pay his bills or perform other transactions using a single QR Code. A user can pay his bill through the BharatPe app using UPI payment platforms like Paytm or Google Pay, etc.

- BharatPe swipe (POS Machine) – It is a card swipe machine of BharatPe launched in 2020. It works on 0% transaction cost. A customer pays his bill through any UPI payment platform. Swiping his card on the BharatPe swipe machine, the merchant then receives such payment and does need not to pay any commission on the transaction. Thus, the merchant earns a decent profit. This is beneficial for small businesses. The company has installed over 1 lakh machines across India.

- 12% club – BharatPe has collaborated with the NBFCs (Non- Banking Financial Company) to launch the “12% club”. It is a customer lending and borrowing app.

- Benefits of this app:

- Users can invest and earn up to 12% annual interest without any lock-in period.

- The customer can borrow up to Rs.10 lacs and can avail of a loan up to Rs. 10 lacs without any collateral for a period of up to 3 months.

- The customer can withdraw his money anytime and anywhere.

- The company does not charge any loan processing amount.

- A customer can start investing with a small amount of Rs. 1000 and receive interest on such an amount.

Read CRED case study: CRED Business Model and How CRED Works | CRED Success Story?

- BharatPe credit cum debit card – A payment instrument card issued by SBM Bank (India) Ltd. in collaboration with Resilient Innovations Pvt. Ltd. It can get used as a debit as well as a credit card. Using this card the customer can get 1% cashback on all the BharatPe spends and also a credit limit of up to Rs. 1 lakh with no transaction fees.

- Bharat X – A fintech company, which enables a consumer-based company in India. To offer credit to its customers by integrating its APIs, BharatPe will work along with AI, Human-Computer Interaction, Econometrics, Data Science, and others.

- Digital gold – In October 2020, the company launched the products Digital Gold in association with “SafeGold”. SafeGold is a digital platform where a customer can buy/ sell 24K gold at low ticket sizes with the click of a button. The merchants can buy/ sell 99.5% pure 24K gold and they can carry out the transactions in rupees or grams using the BharatPe app. To ensure safety in gold purchases, SafeGold appointed IDBI Trusteeship Services. The purchased gold stays within SafeGold lockers with no commission charges with security. Furthermore, the merchant can keep a track of the gold prices linked with global markets.

- BharatPe launched a gold scheme on March 14, 2022, for its merchants by collaborating with RBI-approved NBFCs. The scheme can offer gold loans to the merchants up to a limit of Rs. 20 lacs. The company has already provided gold loans in the cities of Delhi NCR, Bengaluru, and Hyderabad and has plans to expand its offering to more cities by end of 2022.

- BharatPe cricket- The company partnered with the ICC in 2022. To promote the association through digital and broadcast mediums. The partnership will also ensure the involvement of BharatPe. At all ICC events throughout the term. Including ICC Men’s T20 World Cup India 2021, ICC Men’s T20 World Cup Australia 2022, ICC Women’s World Cup NZ 2022, and ICC Men’s World Cup India 2023. This association will enable BharatPe to conduct campaigns. Meant for cricket fans and shop owners across the country. Further, the company has its own “Team BharatPe”. Has 11 cricket stars as its brand ambassadors.

BharatPe Revenue Model:

The company provides a digital payment platform to its customers by focusing on the merchant side of the business. The company has PoS machines to accept card payments. Yet the revenue of the companies comes from its merchant and consumer-based products.

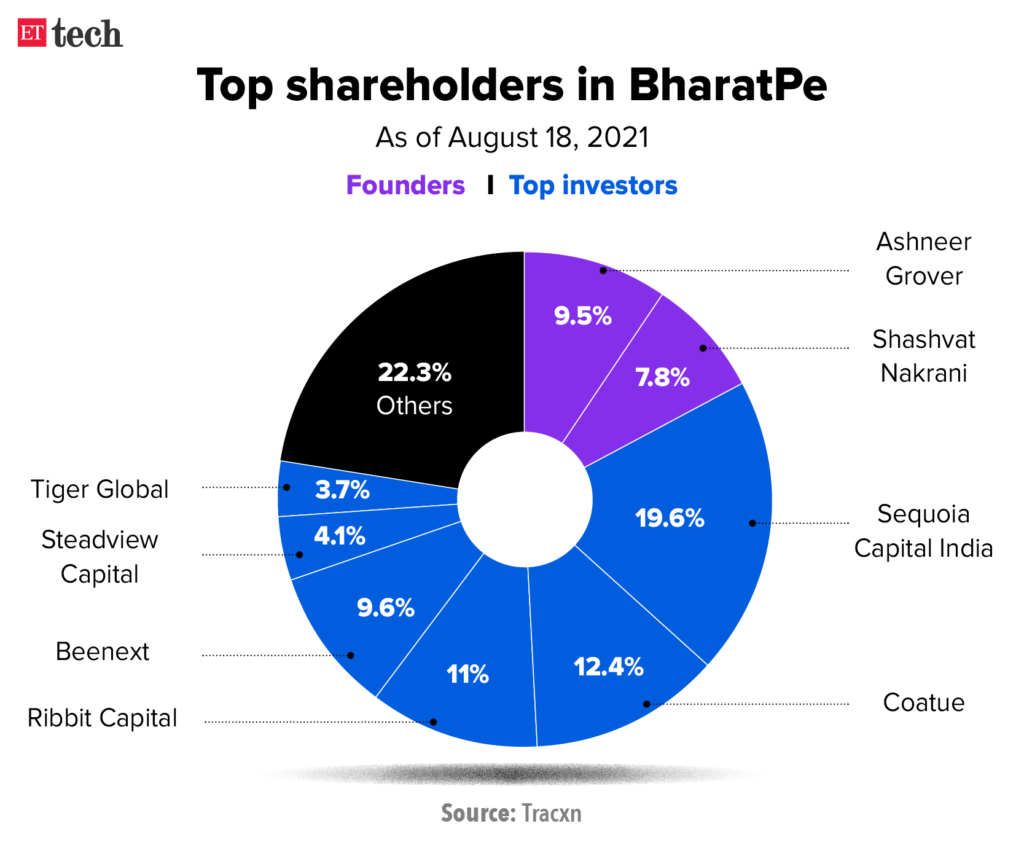

Investors of BharatPe:

BharatPe gets listed as one of the Top 5 most valued Fintech startups in India. 29 investors have invested in the company. Some of its investors are Sequoia Capital, IIFL Wealth, Tiger Global Management, Coatue, Ribbit Capital, and others. BharatPe has 8 million merchants on its platform.

Due to the controversy raised within the company. The co-founder and MD of BharatPe Ashneer Grover resigned from his services. He is the single largest individual shareholder of BharatPe. Based on the investigation reports, he was being asked to sell out his company share of 9.5% but he laid a condition that he would sell out his hard-earned shares in exchange for an investment of Rs. 4000 crores.

He has hired a Delhi NCR-based law firm Karanjawala & Co. to help him through the controversy, but on February 28, 2022, he resigned from the company himself by saying that, he is now wasting himself “fighting a long, lonely battle” against his own investors and management. He called the entire episode a “battle of egos”.

Nykaa Case Study: Nykaa Business Model & How Nykaa Works?

BharatPe ballooning:

The company has been growing since its establishment and has emerged as a powerful digital payment platform.

The process of applying for a loan through BharatPe is completely digital. The business app provides a merchant best offers, and other details before applying for a loan. Such a loan will get disbursed within 30 minutes.

The merchants can opt for loans for a duration of 6, 9, and 12 months, and then repay them through EDI (Easy Daily Instalments). The company has plans to launch an EMI option for the repayment of loans. The QR code-based loans will process with minimal paperwork.

BharatPe has installed over 1 lakh PoS machines across 16 cities in India. That supports transactions over Rs. 1400 crores per month. It has become one of the preferred digital payment platforms for SMEs, Also for Kirana store owners, restaurant owners, and other small businesses with less number of outlets.

The company claims to have disbursed loans amounting to Rs. 150 crores to its merchants during FY20. BharatPe also claims of earning Rs. 6.94 crore from its capital assets during FY20.

BharatPe challenges:

BharatPe has been on the radar of the Directorate General of Goods & Services Tax Intelligence (DGGI) for a long time. The governing body has been looking over the finances of BharatPe and found many loopholes within the organization.

Also, From the findings, Grover and his family have got alleged to getting engaged in extensive misappropriation of company funds and creating fake vendors.

BharatPe competitors:

- MobiKwik (MD & CEO Bipin Preet Singh)

- Google Pay (Founder Sujith Narayanan and Sumit Gwalani)

- Paytm (CEO & Founder Vijay Shekhar Sharma)

- PhonePe (Co-founder & CEO Sameer Nigam)

- PayU (CEO Anirban Mukherjee)

- Razorpay (CEO & co-founder Harshil Mathur) are some of the major competitors of BharatPe.

Read Razorpay Case Study – Success Story of Razorpay

BharatPe future goals:

In 2020, the company launched “Paisa Bolega”, Which converts the merchant’s mobile into a speaker, and announces the amount of the transaction received aloud. The company recently disbursed loans amounting to Rs. 140 crores.

The company stands 3rd in the list of private POS providers. The fintech BharatPe along with the Centum Financial Services group together have plans to take over the troubled Punjab & Maharashtra Cooperative (PMC) Bank. RBI has also approved BharatPe to set up a small finance bank.

Conclusion:

BharatPe has a unique business model. Which makes it stand out from other digital payment platforms. They provide innovative and unique products and services to their customers.

At present they have over 1 million merchants, who use the platform to carry out their transactions and take loans. BharatPe has shown us the scope for business opportunities in India. It believes that the success of a business depends upon understanding its target audiences.

-

What is BharatPe?

BharatPe is a digital payment platform, which provides effortless carrying out of UPI transactions and digital money lending to merchants without any collateral. Through the app, a merchant can receive UPI payments through a single QR code. Called the “BharatPe code”.

-

Who founded BharatPe?

In the beginning, the company got founded by Ashneer Grover, Bhavik Koladiya, and Shashvat Nakrani but due to controversies and varied allegations, Ashneer Grover had to resign from the post of MD and CEO of BharatPe on February 28, 2022.

-

Is BharatPe a government company?

No, BharatPe is a private fintech company.

-

What is BharatPe balance?

BharatPe balance gives the user information about their daily QR usage. Also, the balance in their registered account and their available loan limit.